Swap Curve Construction

在这个示例中,我们将指导用户如何使用平台的功能,完成从利率互换的市场报价完成收益率曲线的构造。

from CAL.PyCAL import *

SetEvaluationDate(Date(2015, 8, 6))

1. 构造收益率曲线

我们从一组市场标准化互换的市场报价中获取收益率曲线的信息:

swap_rates:标准互换对应的固定端利率swap_tenor:标准互换对应的期限

swap_rates = [0.02, 0.03, 0.04 ,0.05, 0.055, 0.06, 0.065, 0.07]

swap_tenor = ['6M', '1Y', '2Y', '3Y', '4Y', '5Y', '7Y', '10Y']

shiborIndex = Shibor('3M')

instruments = []

for rate, tenor in zip(swap_rates, swap_tenor):

print('{0:3s} benchmark Shibor Swap fixed at: {1:.2f}%'.format(tenor, rate*100))

rateHelper = ShiborSwapRateHelper(rate, Period(tenor), Frequency.Quarterly, shiborIndex)

instruments.append(rateHelper)

6M benchmark Shibor Swap fixed at: 2.00%

1Y benchmark Shibor Swap fixed at: 3.00%

2Y benchmark Shibor Swap fixed at: 4.00%

3Y benchmark Shibor Swap fixed at: 5.00%

4Y benchmark Shibor Swap fixed at: 5.50%

5Y benchmark Shibor Swap fixed at: 6.00%

7Y benchmark Shibor Swap fixed at: 6.50%

10Y benchmark Shibor Swap fixed at: 7.00%

通过标准互换校正(calibration)收益率曲线:

calibratedCurve = CalibratedYieldCurve(EvaluationDate(), instruments, 'Actual/365 (Fixed)')

收益率曲线的基本信息:

discount:折现因子forward(%):远期利率zero(%):零息利率

calibratedCurve.curveProfile().head(10)

| date | discount | forward(%) | zero(%) | |

|---|---|---|---|---|

| 2015-08-06 | 2015-08-06 | 1.000000 | 1.994947 | 2.014979 |

| 2015-09-06 | 2015-09-06 | 0.998307 | 1.994947 | 2.014979 |

| 2015-10-06 | 2015-10-06 | 0.996672 | 1.994947 | 2.014979 |

| 2015-11-06 | 2015-11-06 | 0.994984 | 1.994947 | 2.014979 |

| 2015-12-06 | 2015-12-06 | 0.993354 | 1.994947 | 2.014979 |

| 2016-01-06 | 2016-01-06 | 0.991672 | 1.994947 | 2.014979 |

| 2016-02-06 | 2016-02-06 | 0.989994 | 1.994947 | 2.014979 |

| 2016-03-06 | 2016-03-06 | 0.986950 | 4.014304 | 2.276446 |

| 2016-04-06 | 2016-04-06 | 0.983591 | 4.014304 | 2.505840 |

| 2016-05-06 | 2016-05-06 | 0.980351 | 4.014304 | 2.678750 |

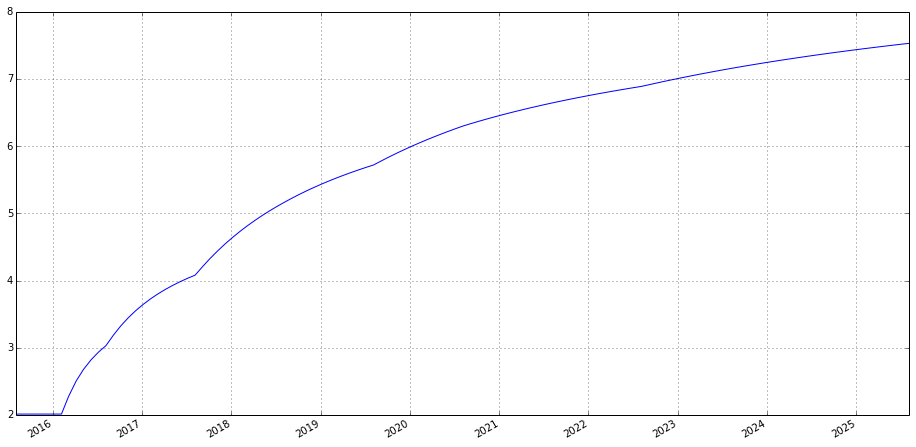

我们可以画图来看:

calibratedCurve.curveProfile()['zero(%)'].plot(figsize=(16,8))

<matplotlib.axes.AxesSubplot at 0x6bbabd0>

2. 测试

首先可以看这条收益率曲线是否真的可以完美定价基准互换(perfectly pricing):

cal = Calendar('China.IB')

startDate = cal.advanceDate(Date(2015, 8, 6), '1B', BizDayConvention.Following)

shiborIndex = Shibor('3M', calibratedCurve)

nominal = 100000000.

pricingEngine = DiscountingSwapEngine(calibratedCurve)

for rate, tenor in zip(swap_rates, swap_tenor):

benchmarkSwap = ShiborSwap(SwapLegType.Payer, nominal, startDate, Period(tenor), Period('3M'), rate, shiborIndex)

benchmarkSwap.setPricingEngine(pricingEngine)

print('{0:3s} benchmark Shibor Swap NPV: {1:>8.4f}'.format(tenor, benchmarkSwap.NPV()))

6M benchmark Shibor Swap NPV: 0.0000

1Y benchmark Shibor Swap NPV: -0.0000

2Y benchmark Shibor Swap NPV: 0.0000

3Y benchmark Shibor Swap NPV: 0.0000

4Y benchmark Shibor Swap NPV: -0.0000

5Y benchmark Shibor Swap NPV: 0.0000

7Y benchmark Shibor Swap NPV: 0.0000

10Y benchmark Shibor Swap NPV: 0.0000

然后我们取一个假设已经存在的互换(seasoned swap),通过这条收益率曲线估计它的现值:

startDate = Date(2015, 7, 15)

shiborIndex.addFixing(Date(2015, 7, 14), 0.045)

customizeSwap = ShiborSwap(SwapLegType.Receiver, nominal, startDate, Period('9Y'), Period('3M'), 0.06, shiborIndex)

customizeSwap.setPricingEngine(pricingEngine)

print('{0:3s} Shibor Swap fixed at {1:.2f}% NPV: {2:15.4f}'.format('9Y',6.00, customizeSwap.NPV()))

9Y Shibor Swap fixed at 6.00% NPV: -6308510.5573

customizeSwap.legAnalysis(0).head(10)

| AMOUNT | NOMINAL | ACCRUAL_START_DATE | ACCRUAL_END_DATE | ACCRUAL_DAYS | INDEX | FIXING_DAYS | FIXING_DATES | INDEX_FIXING | DAY_COUNTER | ACCRUAL_PERIOD | EFFECTIVE_RATE | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| PAYMENT_DATE | ||||||||||||

| 2015-10-15 | 1512329 | 1e+08 | 2015-07-15 | 2015-10-15 | 92 | #NA | #NA | #NA | #NA | Actual/365 (Fixed) | 0.2520548 | 0.06 |

| 2016-01-15 | 1512329 | 1e+08 | 2015-10-15 | 2016-01-15 | 92 | #NA | #NA | #NA | #NA | Actual/365 (Fixed) | 0.2520548 | 0.06 |

| 2016-04-15 | 1495890 | 1e+08 | 2016-01-15 | 2016-04-15 | 91 | #NA | #NA | #NA | #NA | Actual/365 (Fixed) | 0.2493151 | 0.06 |

| 2016-07-15 | 1495890 | 1e+08 | 2016-04-15 | 2016-07-15 | 91 | #NA | #NA | #NA | #NA | Actual/365 (Fixed) | 0.2493151 | 0.06 |

| 2016-10-17 | 1545205 | 1e+08 | 2016-07-15 | 2016-10-17 | 94 | #NA | #NA | #NA | #NA | Actual/365 (Fixed) | 0.2575342 | 0.06 |

| 2017-01-16 | 1495890 | 1e+08 | 2016-10-17 | 2017-01-16 | 91 | #NA | #NA | #NA | #NA | Actual/365 (Fixed) | 0.2493151 | 0.06 |

| 2017-04-17 | 1495890 | 1e+08 | 2017-01-16 | 2017-04-17 | 91 | #NA | #NA | #NA | #NA | Actual/365 (Fixed) | 0.2493151 | 0.06 |

| 2017-07-17 | 1495890 | 1e+08 | 2017-04-17 | 2017-07-17 | 91 | #NA | #NA | #NA | #NA | Actual/365 (Fixed) | 0.2493151 | 0.06 |

| 2017-10-16 | 1495890 | 1e+08 | 2017-07-17 | 2017-10-16 | 91 | #NA | #NA | #NA | #NA | Actual/365 (Fixed) | 0.2493151 | 0.06 |

| 2018-01-15 | 1495890 | 1e+08 | 2017-10-16 | 2018-01-15 | 91 | #NA | #NA | #NA | #NA | Actual/365 (Fixed) | 0.2493151 | 0.06 |

customizeSwap.legAnalysis(1).head(10)

| AMOUNT | NOMINAL | ACCRUAL_START_DATE | ACCRUAL_END_DATE | ACCRUAL_DAYS | INDEX | FIXING_DAYS | FIXING_DATES | INDEX_FIXING | DAY_COUNTER | ACCRUAL_PERIOD | EFFECTIVE_RATE | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| PAYMENT_DATE | ||||||||||||

| 2015-10-15 | 1150000 | 1e+08 | 2015-07-15 | 2015-10-15 | 92 | Shibor3M Actual/360 | 1 | 2015-07-14 | 0.045 | Actual/360 | 0.2555556 | 0.045 |

| 2016-01-15 | 504102.3 | 1e+08 | 2015-10-15 | 2016-01-15 | 92 | Shibor3M Actual/360 | 1 | 2015-10-14 | 0.01972574 | Actual/360 | 0.2555556 | 0.01972574 |

| 2016-04-15 | 871825.4 | 1e+08 | 2016-01-15 | 2016-04-15 | 91 | Shibor3M Actual/360 | 1 | 2016-01-14 | 0.03448979 | Actual/360 | 0.2527778 | 0.03448979 |

| 2016-07-15 | 1005852 | 1e+08 | 2016-04-15 | 2016-07-15 | 91 | Shibor3M Actual/360 | 1 | 2016-04-14 | 0.03979193 | Actual/360 | 0.2527778 | 0.03979193 |

| 2016-10-17 | 1234864 | 1e+08 | 2016-07-15 | 2016-10-17 | 94 | Shibor3M Actual/360 | 1 | 2016-07-14 | 0.04729266 | Actual/360 | 0.2611111 | 0.04729266 |

| 2017-01-16 | 1260227 | 1e+08 | 2016-10-17 | 2017-01-16 | 91 | Shibor3M Actual/360 | 1 | 2016-10-14 | 0.04985512 | Actual/360 | 0.2527778 | 0.04985512 |

| 2017-04-17 | 1260227 | 1e+08 | 2017-01-16 | 2017-04-17 | 91 | Shibor3M Actual/360 | 1 | 2017-01-13 | 0.04985512 | Actual/360 | 0.2527778 | 0.04985512 |

| 2017-07-17 | 1260227 | 1e+08 | 2017-04-17 | 2017-07-17 | 91 | Shibor3M Actual/360 | 1 | 2017-04-14 | 0.04985512 | Actual/360 | 0.2527778 | 0.04985512 |

| 2017-10-16 | 1668056 | 1e+08 | 2017-07-17 | 2017-10-16 | 91 | Shibor3M Actual/360 | 1 | 2017-07-14 | 0.06598904 | Actual/360 | 0.2527778 | 0.06598904 |

| 2018-01-15 | 1790725 | 1e+08 | 2017-10-16 | 2018-01-15 | 91 | Shibor3M Actual/360 | 1 | 2017-10-13 | 0.07084187 | Actual/360 | 0.2527778 | 0.07084187 |