【50ETF期权】 2. 历史波动率

在本文中,我们将通过量化实验室提供的数据,计算上证50ETF的历史波动率数据

from CAL.PyCAL import *

import numpy as np

import pandas as pd

import matplotlib.pyplot as plt

from matplotlib import rc

rc('mathtext', default='regular')

import seaborn as sns

sns.set_style('white')

import math

from scipy.stats import mstats

50ETF收盘价

# 华夏上证50ETF

secID = '510050.XSHG'

begin = Date(2015, 2, 9)

end = Date.todaysDate()

fields = ['tradeDate', 'closePrice']

etf = DataAPI.MktFunddGet(secID, beginDate=begin.toISO().replace('-', ''), endDate=end.toISO().replace('-', ''), field=fields)

etf['tradeDate'] = pd.to_datetime(etf['tradeDate'])

etf = etf.set_index('tradeDate')

etf.tail(3)

| closePrice | |

|---|---|

| tradeDate | |

| 2015-09-22 | 2.237 |

| 2015-09-23 | 2.180 |

| 2015-09-24 | 2.187 |

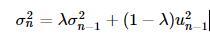

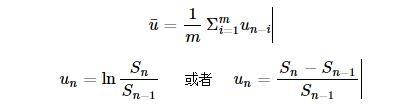

1. EWMA模型计算历史波动率

EWMA(Exponentially Weighted Moving Average)指数加权移动平均计算历史波动率:

其中

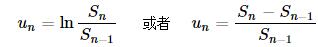

上式中的 Si 为 i 天的收盘价,λ 为介于0和1之间的常数。也就是说,在第 n−1 天估算的第 n 天的波动率估计值 σn 由第 n−1 天的波动率估计值 σn−1 和收盘价在最近一天的变化百分比 un−1 决定。

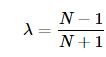

计算周期为 N 天的波动率时, λ 可以取为:

def getHistVolatilityEWMA(secID, beginDate, endDate):

cal = Calendar('China.SSE')

spotBeginDate = cal.advanceDate(beginDate,'-520B',BizDayConvention.Preceding)

spotBeginDate = Date(2006, 1, 1)

begin = spotBeginDate.toISO().replace('-', '')

end = endDate.toISO().replace('-', '')

fields = ['tradeDate', 'preClosePrice', 'closePrice', 'settlePrice', 'preSettlePrice']

security = DataAPI.MktFunddGet(secID, beginDate=begin, endDate=end, field=fields)

security['dailyReturn'] = security['closePrice']/security['preClosePrice'] # 日回报率

security['u2'] = (np.log(security['dailyReturn']))**2 # u2为复利形式的日回报率平方

# security['u2'] = (security['dailyReturn'] - 1.0)**2 # u2为日价格变化百分比的平方

security['tradeDate'] = pd.to_datetime(security['tradeDate'])

periods = {'hv1W': 5, 'hv2W': 10, 'hv1M': 21, 'hv2M': 41, 'hv3M': 62, 'hv4M': 83,

'hv5M': 104, 'hv6M': 124, 'hv9M': 186, 'hv1Y': 249, 'hv2Y': 497}

# 利用pandas中的ewma模型计算波动率

for prd in periods.keys():

# 此处的span实际上就是上面计算波动率公式中lambda表达式中的N

security[prd] = np.round(np.sqrt(pd.ewma(security['u2'], span=periods[prd], adjust=False)), 5)*math.sqrt(252.0)

security = security[security.tradeDate >= beginDate.toISO()]

security = security.set_index('tradeDate')

return security

secID = '510050.XSHG'

start = Date(2015, 2, 9)

end = Date.todaysDate()

hist_HV = getHistVolatilityEWMA(secID, start, end)

hist_HV.tail(2)

| preClosePrice | closePrice | dailyReturn | u2 | hv2M | hv1W | hv1Y | hv3M | hv4M | hv5M | hv2Y | hv1M | hv2W | hv6M | hv9M | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| tradeDate | |||||||||||||||

| 2015-09-23 | 2.237 | 2.180 | 0.974519 | 0.000666 | 0.511318 | 0.304791 | 0.446550 | 0.523224 | 0.519890 | 0.511635 | 0.379718 | 0.449090 | 0.344477 | 0.502269 | 0.472743 |

| 2015-09-24 | 2.180 | 2.187 | 1.003211 | 0.000010 | 0.499095 | 0.250658 | 0.444804 | 0.514969 | 0.513699 | 0.506714 | 0.378925 | 0.428453 | 0.312410 | 0.498142 | 0.470203 |

secID = '510050.XSHG'

start = Date(2007, 1, 1)

end = Date.todaysDate()

hist_HV = getHistVolatilityEWMA(secID, start, end)

## ----- 50ETF历史波动率 -----

fig = plt.figure(figsize=(10,12))

ax = fig.add_subplot(211)

font.set_size(16)

hist_plot = hist_HV[hist_HV.index >= Date(2015,2,9).toISO()]

etf_plot = etf[etf.index >= Date(2015,2,9).toISO()]

lns1 = ax.plot(hist_plot.index, hist_plot.hv1M, '-', label = u'HV(1M)')

lns2 = ax.plot(hist_plot.index, hist_plot.hv2M, '-', label = u'HV(2M)')

ax2 = ax.twinx()

lns3 = ax2.plot(etf_plot.index, etf_plot.closePrice, '-r', label = '50ETF closePrice')

lns = lns1+lns2+lns3

labs = [l.get_label() for l in lns]

ax.legend(lns, labs, loc=2)

ax.grid()

ax.set_xlabel(u"tradeDate")

ax.set_ylabel(r"Historical Volatility")

ax2.set_ylabel(r"closePrice")

ax.set_ylim(0, 0.9)

ax2.set_ylim(1.5, 4)

plt.title('50ETF Historical EWMA Volatility')

## -----------------------------------

## ----- 50ETF历史波动率统计数据 -----

# 注意: 该统计数据基于07年以来将近九年的历史波动率得出

ax3 = fig.add_subplot(212)

font.set_size(16)

hist_plot = hist_HV[[u'hv2W', u'hv1M', u'hv2M', u'hv3M', u'hv4M', u'hv5M', u'hv6M', u'hv9M', u'hv1Y']]

# Calculate the quantiles column wise

quantiles = mstats.mquantiles(hist_plot, prob=[0.0, 0.25, 0.5, 0.75, 1.0], axis=0)

labels = ['Minimum', '1st quartile', 'Median', '3rd quartile', 'Maximum']

for i, q in enumerate(quantiles):

ax3.plot(q, label=labels[i])

# 在统计图中标出某一天的波动率

date = Date(2015,8,27)

last_day_HV = hist_plot.ix[date.toDateTime()].T

ax3.plot(last_day_HV.values, 'dr', label=date.toISO())

# 在统计图中标出最近一天的波动率

last_day_HV = hist_plot.tail(1).T

ax3.plot(last_day_HV.values, 'sb', label=Date.fromDateTime(last_day_HV.columns[0]).toISO())

ax3.set_ylabel(r"Volatility")

plt.xticks((0,1,2,3,4,5,6,7,8),(0.5,1,2,3,4,5,6,9,12))

plt.xlabel('Periods(Months)')

plt.legend()

plt.grid()

波动率图中,上图表示50ETF收盘价格和历史波动率的走势关系:

- 显然,短周期波动率对于近期的波动更敏感

- 收盘价的下跌往往伴随着波动率的上升,两者的负相关性质明显

波动率图中,下图表示50ETF历史波动率的统计数据,图中给出了四分位波动率锥:

- 8月底时,各个周期历史波动率均处于历史高位

- 目前,短周期波动率已经有所回落

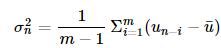

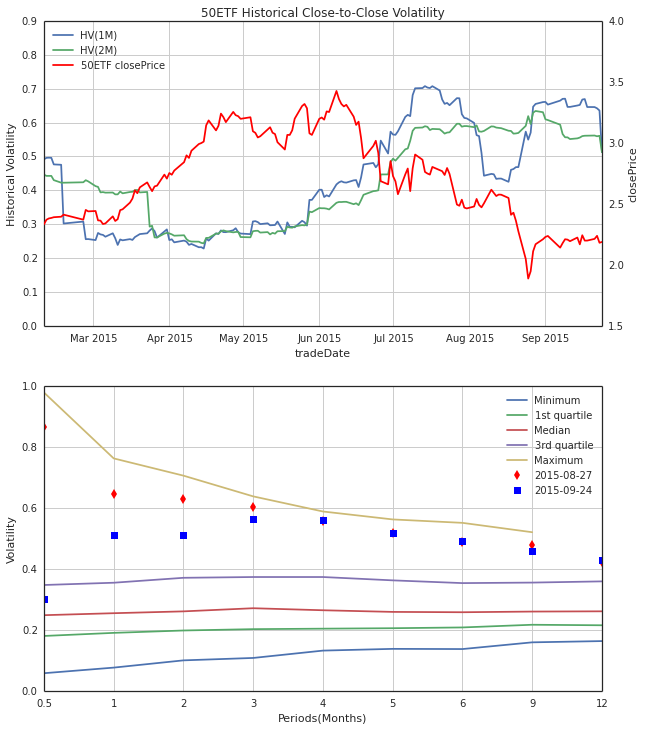

2. Close to Close 模型计算历史波动率

m 天周期的Close to Close波动率:

其中

也就是说,在第 n−1 天估算的第 n 天的波动率估计值 σn 由前面 m天的每日收盘价变化百分比 ui 的标准差决定。

## 计算一段时间标的的历史波动率,返回值包括以下不同周期的波动率:

# 一周,半月,一个月,两个月,三个月,四个月,五个月,半年,九个月,一年,两年

def getHistVolatilityC2C(secID, beginDate, endDate):

cal = Calendar('China.SSE')

spotBeginDate = cal.advanceDate(beginDate,'-520B',BizDayConvention.Preceding)

spotBeginDate = Date(2006, 1, 1)

begin = spotBeginDate.toISO().replace('-', '')

end = endDate.toISO().replace('-', '')

fields = ['tradeDate', 'preClosePrice', 'closePrice', 'settlePrice', 'preSettlePrice']

security = DataAPI.MktFunddGet(secID, beginDate=begin, endDate=end, field=fields)

security['dailyReturn'] = security['closePrice']/security['preClosePrice'] # 日回报率

security['u'] = np.log(security['dailyReturn']) # u2为复利形式的日回报率

security['tradeDate'] = pd.to_datetime(security['tradeDate'])

periods = {'hv1W': 5, 'hv2W': 10, 'hv1M': 21, 'hv2M': 41, 'hv3M': 62, 'hv4M': 83,

'hv5M': 104, 'hv6M': 124, 'hv9M': 186, 'hv1Y': 249, 'hv2Y': 497}

# 利用方差模型计算波动率

for prd in periods.keys():

security[prd] = np.round(pd.rolling_std(security['u'], window=periods[prd]), 5)*math.sqrt(252.0)

security = security[security.tradeDate >= beginDate.toISO()]

security = security.set_index('tradeDate')

return security

secID = '510050.XSHG'

start = Date(2007, 1, 1)

end = Date.todaysDate()

hist_HV = getHistVolatilityC2C(secID, start, end)

## ----- 50ETF历史波动率 -----

fig = plt.figure(figsize=(10,12))

ax = fig.add_subplot(211)

font.set_size(16)

hist_plot = hist_HV[hist_HV.index >= Date(2015,2,9).toISO()]

etf_plot = etf[etf.index >= Date(2015,2,9).toISO()]

lns1 = ax.plot(hist_plot.index, hist_plot.hv1M, '-', label = u'HV(1M)')

lns2 = ax.plot(hist_plot.index, hist_plot.hv2M, '-', label = u'HV(2M)')

ax2 = ax.twinx()

lns3 = ax2.plot(etf_plot.index, etf_plot.closePrice, '-r', label = '50ETF closePrice')

lns = lns1+lns2+lns3

labs = [l.get_label() for l in lns]

ax.legend(lns, labs, loc=2)

ax.grid()

ax.set_xlabel(u"tradeDate")

ax.set_ylabel(r"Historical Volatility")

ax2.set_ylabel(r"closePrice")

ax.set_ylim(0, 0.9)

ax2.set_ylim(1.5, 4)

plt.title('50ETF Historical Close-to-Close Volatility')

## -----------------------------------

## ----- 50ETF历史波动率统计数据 -----

# 注意: 该统计数据基于07年以来将近九年的历史波动率得出

ax3 = fig.add_subplot(212)

font.set_size(16)

hist_plot = hist_HV[[u'hv2W', u'hv1M', u'hv2M', u'hv3M', u'hv4M', u'hv5M', u'hv6M', u'hv9M', u'hv1Y']]

# Calculate the quantiles column wise

quantiles = mstats.mquantiles(hist_plot, prob=[0.0, 0.25, 0.5, 0.75, 1.0], axis=0)

labels = ['Minimum', '1st quartile', 'Median', '3rd quartile', 'Maximum']

for i, q in enumerate(quantiles):

ax3.plot(q, label=labels[i])

# 在统计图中标出某一天的波动率

date = Date(2015,8,27)

last_day_HV = hist_plot.ix[date.toDateTime()].T

ax3.plot(last_day_HV.values, 'dr', label=date.toISO())

# 在统计图中标出最近一天的波动率

last_day_HV = hist_plot.tail(1).T

ax3.plot(last_day_HV.values, 'sb', label=Date.fromDateTime(last_day_HV.columns[0]).toISO())

ax3.set_ylabel(r"Volatility")

plt.xticks((0,1,2,3,4,5,6,7,8),(0.5,1,2,3,4,5,6,9,12))

plt.xlabel('Periods(Months)')

plt.legend()

plt.grid()

波动率图中,上图表示50ETF收盘价格和历史波动率的走势关系:

- 显然,短周期波动率对于近期的波动更敏感

- 收盘价的下跌往往伴随着波动率的上升,两者的负相关性质明显

波动率图中,下图表示50ETF历史波动率的统计数据,图中给出了四分位波动率锥:

- 8月底时,各个周期历史波动率均处于历史高位

- 目前,短周期波动率已经有所回落

明显地,相对于EWMA计算的历史波动率,Close to Close波动率对于最近价格波动反应比较迟钝