基于期权PCR指数的择时策略

P/C作为市场情绪指标

计算方式

P/C比例作为一种反向情绪指标,是看跌期权的成交量(成交额,持仓量等)与看涨期权的成交量(持仓量)的比值。

指标含义

- 看跌期权的成交量可以作为市场看空力量多寡的衡量;

- 看涨期权的成交量可以描述市场看多力量。

指标应用

- 当P/C比例过小达到一个极端时,被视为市场过度乐观,此时市场将遏制原来的上涨趋势;

- 当P/C比例过大到达另一个极端时,被视为市场过度悲观,此时市场可能出现反弹。

策略思路

比较交易日之前两日的PCR(Put Call Ratio)指数:

PCR上升时,市场恐慌情绪蔓延,卖出

PCR下降时,恐慌情绪有所舒缓,买入

注:国内唯一一只期权上证50ETF期权,跟踪标的为华夏上证50ETF(510050)基金

1. 计算历史PCR指数

from matplotlib import pylab

import numpy as np

import pandas as pd

import DataAPI

import seaborn as sns

sns.set_style('white')

def getHistDayOptions(var, date):

# 使用DataAPI.OptGet,拿到已退市和上市的所有期权的基本信息;

# 同时使用DataAPI.MktOptdGet,拿到历史上某一天的期权成交信息;

# 返回历史上指定日期交易的所有期权信息,包括:

# optID varSecID contractType strikePrice expDate tradeDate closePrice turnoverValue

# 以optID为index。

dateStr = date.toISO().replace('-', '')

optionsMkt = DataAPI.MktOptdGet(tradeDate = dateStr, field = [u"optID", "tradeDate", "closePrice", "turnoverValue"], pandas = "1")

optionsMkt = optionsMkt.set_index(u"optID")

optionsMkt.closePrice.name = u"price"

optionsID = map(str, optionsMkt.index.values.tolist())

fieldNeeded = ["optID", u"varSecID", u'contractType', u'strikePrice', u'expDate']

optionsInfo = DataAPI.OptGet(optID=optionsID, contractStatus = [u"DE", u"L"], field=fieldNeeded, pandas="1")

optionsInfo = optionsInfo.set_index(u"optID")

options = concat([optionsInfo, optionsMkt], axis=1, join='inner').sort_index()

return options[options.varSecID==var]

def calDayTurnoverValuePCR(optionVarSecID, date):

# 计算历史每日的看跌看涨期权交易额的比值

# PCR: put call ratio

options = getHistDayOptions(optionVarSecID, date)

call = options[options.contractType==u"CO"]

put = options[options.contractType==u"PO"]

callTurnoverValue = call.turnoverValue.sum()

putTurnoverValue = put.turnoverValue.sum()

return 1.0 * putTurnoverValue / callTurnoverValue

def getHistPCR(beginDate, endDate):

# 计算历史一段时间内的PCR指数并返回

optionVarSecID = u"510050.XSHG"

cal = Calendar('China.SSE')

dates = cal.bizDatesList(beginDate, endDate)

dates = map(Date.toDateTime, dates)

histPCR = pd.DataFrame(0.0, index=dates, columns=['PCR'])

histPCR.index.name = 'date'

for date in histPCR.index:

histPCR['PCR'][date] = calDayTurnoverValuePCR(optionVarSecID, Date.fromDateTime(date))

return histPCR

def getDayPCR(date):

# 计算历史一段时间内的PCR指数并返回

optionVarSecID = u"510050.XSHG"

return calDayTurnoverValuePCR(optionVarSecID, date)

secID = '510050.XSHG'

begin = Date(2015, 2, 9)

end = Date(2015, 7, 30)

getHistPCR(begin, end).tail()

| PCR | |

|---|---|

| date | |

| 2015-07-24 | 1.032107 |

| 2015-07-27 | 2.097952 |

| 2015-07-28 | 2.288790 |

| 2015-07-29 | 1.971831 |

| 2015-07-30 | 1.527717 |

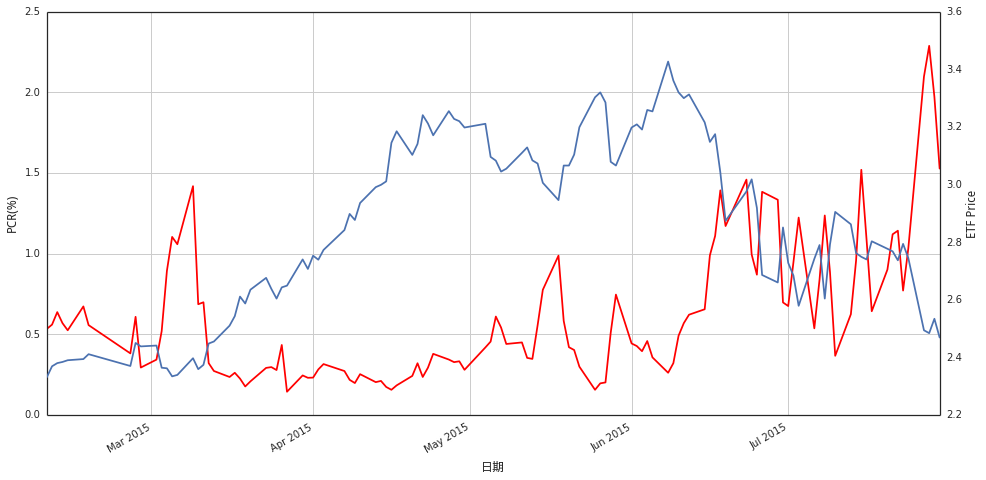

2. PCR指数与华夏上证50ETF基金的走势对比

secID = '510050.XSHG'

begin = Date(2015, 2, 9)

end = Date(2015, 7, 30)

# 历史PCR

histPCR = getHistPCR(begin, end)

# 华夏上证50ETF

etf = DataAPI.MktFunddGet(secID, beginDate=begin.toISO().replace('-', ''), endDate=end.toISO().replace('-', ''), field=['tradeDate', 'closePrice'])

etf['tradeDate'] = pd.to_datetime(etf['tradeDate'])

etf = etf.set_index('tradeDate')

font.set_size(12)

pylab.figure(figsize = (16,8))

ax1 = histPCR.plot(x=histPCR.index, y='PCR', style='r')

ax1.set_xlabel(u'日期', fontproperties=font)

ax1.set_ylabel(u'PCR(%)', fontproperties=font)

ax2 = ax1.twinx()

ax2.plot(etf.index,etf.closePrice)

ax2.set_ylabel(u'ETF Price', fontproperties=font)

<matplotlib.text.Text at 0x78a4d90>

从上图可以看出,每次PC指标的上升都对应着标的价格的下挫

3. 基于PCR指数的择时策略示例

start = datetime(2015, 2, 9) # 回测起始时间

end = datetime(2015, 7, 31) # 回测结束时间

benchmark = '510050.XSHG' # 策略参考标准

universe = ['510050.XSHG'] # 股票池

capital_base = 100000 # 起始资金

commission = Commission(0.0,0.0)

longest_history = 1

histPCR = getHistPCR(start, end)

def initialize(account): # 初始化虚拟账户状态

account.fund = universe[0]

def handle_data(account): # 每个交易日的买入卖出指令

hist = account.get_history(longest_history)

fund = account.fund

# 获取回测当日的前一天日期

dt = Date.fromDateTime(account.current_date)

cal = Calendar('China.IB')

lastTDay = cal.advanceDate(dt,'-1B',BizDayConvention.Preceding) #计算出倒数第一个交易日

lastLastTDay = cal.advanceDate(lastTDay,'-1B',BizDayConvention.Preceding) #计算出倒数第二个交易日

last_day_str = lastTDay.strftime("%Y-%m-%d")

last_last_day_str = lastLastTDay.strftime("%Y-%m-%d")

# 计算买入卖出信号

try:

pcr_last = histPCR['PCR'].loc[last_day_str] # 计算短均线值

pcr_last_last = histPCR['PCR'].loc[last_last_day_str] # 计算长均线值

long_flag = True if (pcr_last - pcr_last_last) < 0 else False

except:

return

if long_flag:

if account.position.secpos.get(fund, 0) == 0:

# 空仓时全仓买入,买入股数为100的整数倍

approximationAmount = int(account.cash / hist[fund]['closePrice'][-1]/100.0) * 100

order(fund, approximationAmount)

else:

# 卖出时,全仓清空

if account.position.secpos.get(fund, 0) >= 0:

order_to(fund, 0)

基于PCR指数上升时空仓、下降时进场的策略来买卖标的,可以比较有效地降低标的大跌的风险