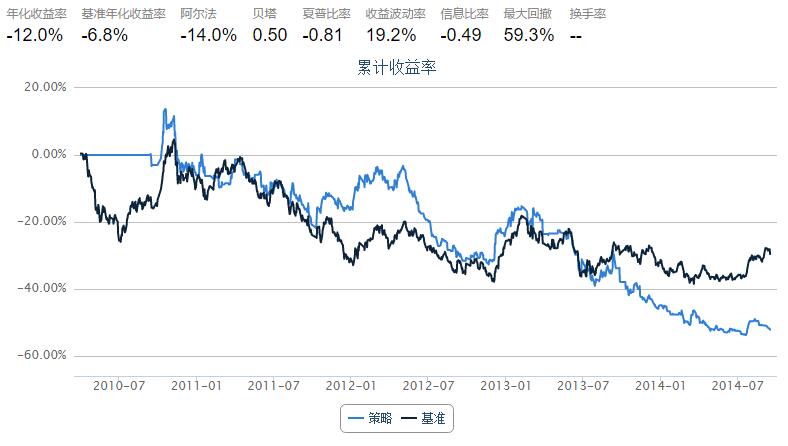

基于Random Forest的决策策略

版本:1.0

作者:李丞

利用随机树分类算法,通过历史价格的上升状态变化规律,预测下一日股价变动的方向。预测上涨则买入,下跌则卖出(如果可以的话);

from sklearn.ensemble import RandomForestClassifier

from collections import deque

import pandas as pd

import numpy as np

start = pd.datetime(2010, 4, 1)

end = pd.datetime(2014, 9, 16)

longest_history = 1

bm = 'HS300'

universe = ['600000.XSHG']

csvs = []

capital_base = 1e5

refresh_rate = 1

window_length = 10

def initialize(account):

account.security = universe[0]

account.window_length = window_length

account.classifier = RandomForestClassifier()

# 先进先出的deque序列,设定了最长的长度,在序列超过最长长度的时候,会将头部序列移出

account.recent_prices = deque(maxlen=account.window_length+2) # 保存最近的股价

account.X = deque(maxlen=100) # 自变量

account.Y = deque(maxlen=100) # 应变量

account.prediction = 0 # 保存最近的预测值

def handle_data(account):

hist = account.get_history(1)

if account.security in hist:

account.recent_prices.append(hist[account.security]['closePrice'][0]) # 更新最近的股价

if len(account.recent_prices) >= account.window_length+2: # 如果我们已经获取了足够的股价

RecentPrice=list(account.recent_prices) # 将deque转换为对应的list

# 制作一组1和0,标记股价是否相对于上一日价格上升。

changes = np.diff(RecentPrice) > 0

account.X.append(RecentPrice[1:-1])

account.Y.append(changes[-1])

if len(account.Y) >= 100: # 已经拥有足够的数据im

account.classifier.fit(account.X, account.Y) # 设定模型

account.prediction = account.classifier.predict(changes[1:]) # 预测

# 如果过大0.5,买入;小于0.5,卖出

if account.prediction > 0.5:

buyAmount = int(account.position.cash / hist[account.security]['closePrice'][0])

order(account.security, buyAmount)

else:

order_to(account.security, 0)