4.5 CCI • CCI 顺势指标探索

一、CCI指标简介与构造

顺势指标CCI由唐纳德拉姆伯特所创,是通过测量股价的波动是否已超出其正常范围,来预测股价变化趋势的技术分析指标。计算方法参考《技术指标系列(五)——CCI的顺势而为 》。

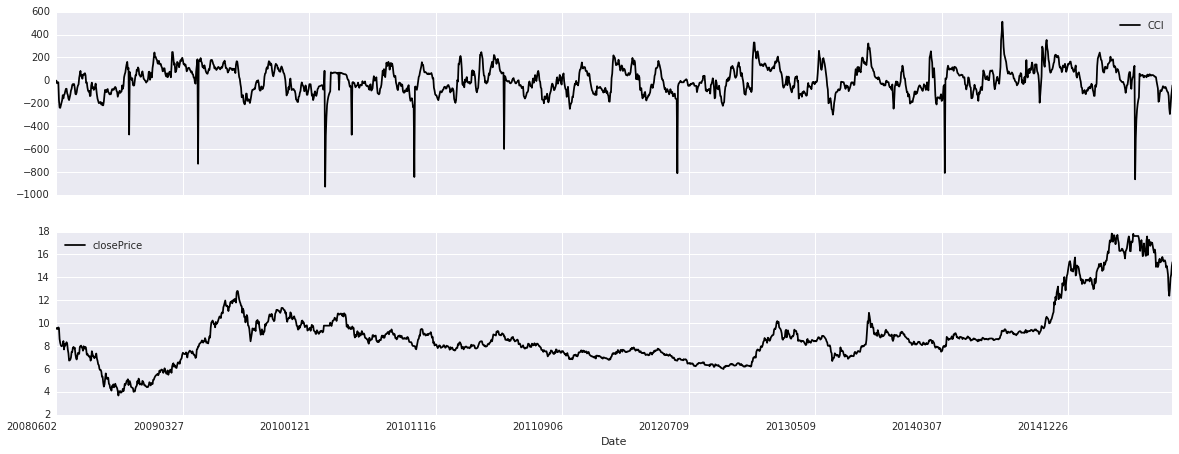

下面描绘出CCI与股价时序图走势

def cci(stock,start_date,end_date,windows): #设置股票,起始时间,以及CCI指标多少日

import pandas as pd

import numpy as np

from CAL.PyCAL import *

Alpha = 0.015

eq_TP = {}

eq_MATP = {}

eq_meanDev = {}

eq_CCI = {}

cal = Calendar('China.SSE')

windows = '-'+str(windows)+'B'

start_date = Date.strptime(start_date,"%Y%m%d")

end_date = Date.strptime(end_date,"%Y%m%d")

timeLength = cal.bizDatesList(start_date, end_date)

for i in xrange(len(timeLength)):

begin_date = cal.advanceDate(timeLength[i],windows,BizDayConvention.Unadjusted)

begin_date =begin_date.strftime("%Y%m%d")

timeLength[i] = timeLength[i].strftime("%Y%m%d")

eq_static = DataAPI.MktEqudAdjGet(secID=stock,beginDate=begin_date,endDate=timeLength[i],field=['secID','highestPrice','lowestPrice','closePrice'],pandas="1")

for stk in stock:

try:

eq_TP[stk] = np.array(eq_static[eq_static['secID'] == stk].mean(axis=1))

eq_MATP[stk] = sum(eq_TP[stk])/len(eq_TP[stk])

eq_meanDev[stk] = sum(abs(eq_TP[stk] - eq_MATP[stk]))/len(eq_TP[stk])

eq_CCI[stk].append((eq_TP[stk][-1] - eq_MATP[stk])/(Alpha * eq_meanDev[stk]))

except:

eq_CCI[stk] = []

Date = pd.DataFrame(timeLength)

eq_CCI = pd.DataFrame(eq_CCI)

cciSeries = pd.concat([Date,eq_CCI],axis =1)

cciSeries.columns = ['Date','CCI']

return cciSeries

def cci_price_Plot(stock,start_date,end_date,windows):

cciSeries = cci(stock,start_date,end_date,windows)

closePrice = DataAPI.MktEqudAdjGet(secID=stock,beginDate=start_date,endDate=end_date,field=['closePrice'],pandas="1")

table = pd.merge(cciSeries,closePrice, left_index=True, right_index=True, how = 'inner')

return table

import pandas as pd

import numpy as np

from CAL.PyCAL import *

cal = Calendar('China.SSE')

table = cci_price_Plot(['600000.XSHG'],'20080531','20150901',30) #绘制浦发银行的CCI与股价对比图

tableDate = table.set_index('Date')

tableDate.plot(figsize=(20,8),subplots = 1)

array([<matplotlib.axes.AxesSubplot object at 0x60037d0>,

<matplotlib.axes.AxesSubplot object at 0x602fa90>], dtype=object)

二、CCI指标简单应用

选取CCI处于100和150之间,开始处于上涨趋势的股票。关于windows,我们用quick_backtest做一个简单的优化

def cci(account,N=20):

Alpha = 0.015

eq_TP = {}

eq_MATP = {}

eq_meanDev = {}

eq_CCI = {}

eq_highPrice = account.get_attribute_history('highPrice',N)

eq_closePrice = account.get_attribute_history('closePrice',N)

eq_lowPrice = account.get_attribute_history('lowPrice',N)

for stk in account.universe:

eq_TP[stk] = (eq_highPrice[stk] + eq_closePrice[stk] + eq_lowPrice[stk])/3

eq_MATP[stk] = sum(eq_TP[stk])/len(eq_TP[stk])

eq_meanDev[stk] = sum(abs(eq_TP[stk] - eq_MATP[stk]))/len(eq_TP[stk])

eq_CCI[stk] = (eq_TP[stk][-1] - eq_MATP[stk])/(Alpha * eq_meanDev[stk])

return eq_CCI

start = '2010-08-01' # 回测起始时间

end = '2014-08-01' # 回测结束时间

benchmark = 'HS300' # 策略参考标准

universe = set_universe('HS300') # 证券池,支持股票和基金

capital_base = 100000 # 起始资金

freq = 'd' # 策略类型,'d'表示日间策略使用日线回测,'m'表示日内策略使用分钟线回测

refresh_rate = 20 # 调仓频率,表示执行handle_data的时间间隔,若freq = 'd'时间间隔的单位为交易日,若freq = 'm'时间间隔为分钟

sim_params = quartz.sim_condition.env.SimulationParameters(start, end, benchmark, universe, capital_base)

idxmap_all, data_all = quartz.sim_condition.data_generator.get_daily_data(sim_params)

from CAL.PyCAL import *

import pandas as pd

import numpy as np

def initialize(account): # 初始化虚拟账户状态

pass

def handle_data(account): # 每个交易日的买入卖出指令

eq_CCI = cci(account,window)

buylist = []

for stk in account.universe:

try:

if eq_CCI[stk] > 100 and eq_CCI[stk] < 150:

buylist.append(stk)

except:

pass

for stk in account.valid_secpos:

order_to(stk, 0)

for stk in buylist[:]:

if stk not in account.universe or account.referencePrice[stk] == 0 or np.isnan(account.referencePrice[stk]):

bulist.remove(stk)

for stk in buylist:

order(stk, account.referencePortfolioValue/account.referencePrice[stk]/len(buylist))

print 'window annualized_return sharpe max_drawdown'

for window in range(10, 100, 5):

strategy = quartz.sim_condition.strategy.TradingStrategy(initialize, handle_data)

bt_test, acct = quartz.quick_backtest(sim_params, strategy, idxmap_all, data_all,refresh_rate = refresh_rate)

perf = quartz.perf_parse(bt_test, acct)

print ' {0:2d} {1:>7.4f} {2:>7.4f} {3:>7.4f}'.format(window, perf['annualized_return'], perf['sharpe'], perf['max_drawdown'])

window annualized_return sharpe max_drawdown

10 0.0186 -0.0610 0.4161

15 -0.0367 -0.2818 0.5448

20 0.0753 0.1734 0.4531

25 0.0268 -0.0254 0.3098

30 -0.0440 -0.3198 0.5640

35 0.0481 0.0599 0.4794

40 0.1117 0.3270 0.4057

45 0.0619 0.1176 0.2353

50 -0.0425 -0.3442 0.4226

55 0.0227 -0.0577 0.3355

60 0.0513 0.0540 0.4461

65 0.0860 0.1969 0.2304

70 0.0434 0.0218 0.3005

75 0.0126 -0.1176 0.3672

80 0.0891 0.2084 0.3728

85 0.1002 0.2554 0.2971

90 0.0768 0.1687 0.2710

95 0.0243 -0.0588 0.3461

from CAL.PyCAL import *

import pandas as pd

import numpy as np

start = '2010-08-01' # 回测起始时间

end = '2014-08-01' # 回测结束时间

benchmark = 'HS300' # 策略参考标准

universe = set_universe('HS300') # 证券池,支持股票和基金

capital_base = 100000 # 起始资金

freq = 'd' # 策略类型,'d'表示日间策略使用日线回测,'m'表示日内策略使用分钟线回测

refresh_rate = 20 # 调仓频率,表示执行handle_data的时间间隔,若freq = 'd'时间间隔的单位为交易日,若freq = 'm'时间间隔为分钟

def initialize(account): # 初始化虚拟账户状态

pass

def handle_data(account): # 每个交易日的买入卖出指令

eq_CCI = cci(account,85)

buylist = []

for stk in account.universe:

try:

if eq_CCI[stk] > 100 and eq_CCI[stk] < 150:

buylist.append(stk)

except:

pass

for stk in account.valid_secpos:

order_to(stk, 0)

for stk in buylist[:]:

if stk not in account.universe or account.referencePrice[stk] == 0 or np.isnan(account.referencePrice[stk]):

bulist.remove(stk)

for stk in buylist:

order(stk, account.referencePortfolioValue/account.referencePrice[stk]/len(buylist))

样本外测试

from CAL.PyCAL import *

import pandas as pd

import numpy as np

start = '2014-08-01' # 回测起始时间

end = '2015-08-01' # 回测结束时间

benchmark = 'HS300' # 策略参考标准

universe = set_universe('HS300') # 证券池,支持股票和基金

capital_base = 100000 # 起始资金

freq = 'd' # 策略类型,'d'表示日间策略使用日线回测,'m'表示日内策略使用分钟线回测

refresh_rate = 20 # 调仓频率,表示执行handle_data的时间间隔,若freq = 'd'时间间隔的单位为交易日,若freq = 'm'时间间隔为分钟

def initialize(account): # 初始化虚拟账户状态

pass

def handle_data(account): # 每个交易日的买入卖出指令

eq_CCI = cci(account,85)

buylist = []

for stk in account.universe:

try:

if eq_CCI[stk] > 100 and eq_CCI[stk] < 150:

buylist.append(stk)

except:

pass

for stk in account.valid_secpos:

order_to(stk, 0)

for stk in buylist[:]:

if stk not in account.universe or account.referencePrice[stk] == 0 or np.isnan(account.referencePrice[stk]):

bulist.remove(stk)

for stk in buylist:

order(stk, account.referencePortfolioValue/account.referencePrice[stk]/len(buylist))