羊驼策略

策略实现

羊驼做为上古十大神兽之一, 选股祥瑞, 名号响亮, 本策略由一个羊驼类负责每周生成买入卖出信号, 验证羊驼是否名实相符.

- 投资域 :沪深300成分股

- 业绩基准 :沪深300指数

- 调仓频率 :5个交易日

- 买入卖出信号 :初始时任意买10只羊驼,每次调仓时,剔除收益最差的一只羊驼,再任意买一只羊驼.

- 回测周期 :2014年1月1日至2015年5月5日

import numpy as np

import operator

from datetime import datetime

start = datetime(2010, 1, 1)

end = datetime(2015, 5, 5)

benchmark = 'HS300'

universe = set_universe('HS300')

capital_base = 100000

longest_history = 10

refresh_rate = 5

def initialize(account):

account.stocks_num = 10

def handle_data(account):

hist_prices = account.get_attribute_history('closePrice', 5)

yangtuos = list(YangTuo(set(account.universe)-set(account.valid_secpos.keys()), account.stocks_num))

cash = account.cash

if account.stocks_num == 1:

hist_returns = {}

for stock in account.valid_secpos:

hist_returns[stock] = hist_prices[stock][-1]/hist_prices[stock][0]

sorted_returns = sorted(hist_returns.items(), key=operator.itemgetter(1))

sell_stock = sorted_returns[0][0]

cash = account.cash + hist_prices[sell_stock][-1]*account.valid_secpos.get(sell_stock)

order_to(sell_stock, 0)

else:

account.stocks_num = 1

for stock in yangtuos:

order(stock, cash/len(yangtuos)/hist_prices[stock][-1])

class YangTuo:

def __init__(self, caoyuan=[], count=10):

self.count = count

self.i = 0

self.caoyuan = list(caoyuan)

def __iter__(self):

return self

def next(self):

if self.i < self.count:

self.i += 1

return self.caoyuan.pop(np.random.randint(len(self.caoyuan)))

else:

raise StopIteration()

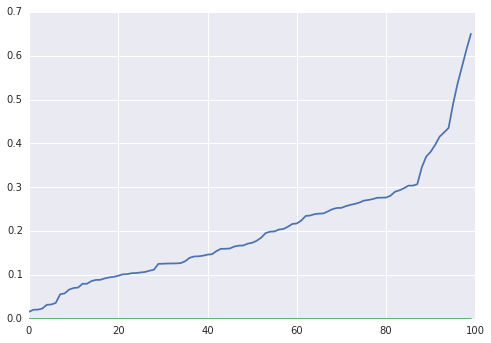

也许你会说,这只是运气好,并不能说明羊驼的厉害啊!好,接下来我们运行100次,看看羊驼的威力.

start = datetime(2010, 1, 1)

end = datetime(2015, 5, 5)

benchmark = 'HS300'

universe = set_universe('HS300')

capital_base = 100000

sim_params = quartz.sim_condition.env.SimulationParameters(start, end, benchmark, universe, capital_base)

idxmap_all, data_all = quartz.sim_condition.data_generator.get_daily_data(sim_params)

import numpy as np

import operator

longest_history = 10

refresh_rate = 5

def initialize(account):

account.stocks_num = 10

def handle_data(account):

hist_prices = account.get_attribute_history('closePrice', 5)

yangtuos = list(YangTuo(set(account.universe)-set(account.valid_secpos.keys()), account.stocks_num))

cash = account.cash

if account.stocks_num == 1:

hist_returns = {}

for stock in account.valid_secpos:

hist_returns[stock] = hist_prices[stock][-1]/hist_prices[stock][0]

sorted_returns = sorted(hist_returns.items(), key=operator.itemgetter(1))

sell_stock = sorted_returns[0][0]

cash = account.cash + hist_prices[sell_stock][-1]*account.valid_secpos.get(sell_stock)

order_to(sell_stock, 0)

else:

account.stocks_num = 1

for stock in yangtuos:

order(stock, cash/len(yangtuos)/hist_prices[stock][-1])

class YangTuo:

def __init__(self, caoyuan=[], count=10):

self.count = count

self.i = 0

self.caoyuan = list(caoyuan)

def __iter__(self):

return self

def next(self):

if self.i < self.count:

self.i += 1

return self.caoyuan.pop(np.random.randint(len(self.caoyuan)))

else:

raise StopIteration()

strategy = quartz.sim_condition.strategy.TradingStrategy(initialize, handle_data)

perfs = []

for i in xrange(100):

bt, acct = quartz.quick_backtest(sim_params, strategy, idxmap_all, data_all, refresh_rate = refresh_rate, longest_history=longest_history)

perf = quartz.perf_parse(bt, acct)

perfs.append(perf)

from matplotlib import pylab

import seaborn

x = sorted([p['annualized_return']-p['benchmark_annualized_return'] for p in perfs])

pylab.plot(x)

pylab.plot([0]*len(x))

[<matplotlib.lines.Line2D at 0x7702a10>]

100%的胜率! 大家闭着眼睛,跟着羊驼买就行了!

接下来的工作:

由于指数并没有分红等概念, 直接拿HS300指数做benchmark, 对HS300并不公平. 所以接下来考虑把benchmark换成某只指数基金, 再做对比.