量化分析师的Python日记【第13天 Q Quant兵器谱之偏微分方程3】

来源:https://uqer.io/community/share/555dc9e8f9f06c6c7404f96e

欢迎来到 Black - Scholes — Merton 的世界!本篇中我们将使用在第11天学习到的知识应用到这个金融学的具体方程之上!

import numpy as np

import math

import seaborn as sns

from matplotlib import pylab

font.set_size(15)

1. 问题的提出

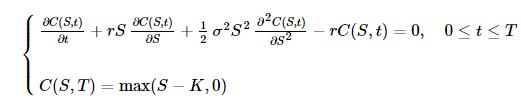

BSM模型可以设置为如下的偏微分方差初值问题:

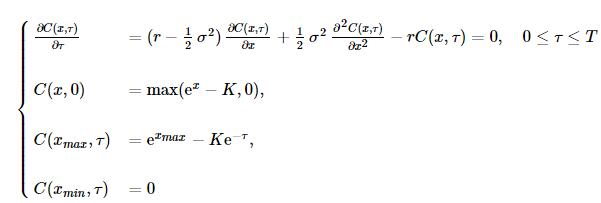

做变量替换τ=T−t,并且设置上下边界条件:

2. 算法

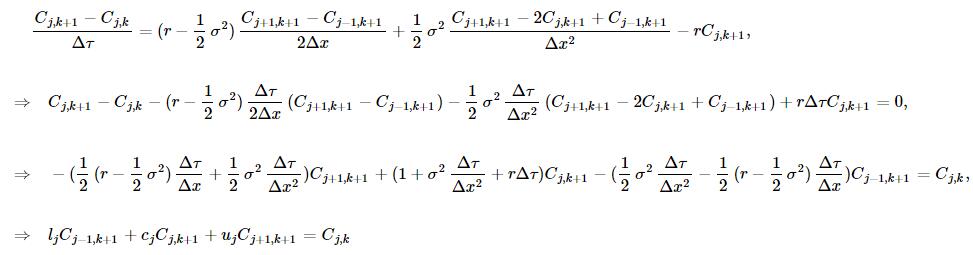

按照之前介绍的隐式差分格式的方法,用离散差分格式代替连续微分:

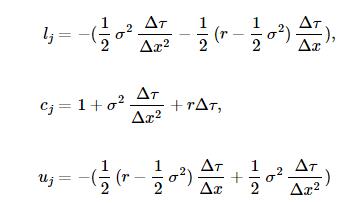

其中

以上即为差分方程组。

这里有些细节需要处理,就是左右边界条件,我们这里使用Dirichlet边界条件,则:

3.实现

import scipy as sp

from scipy.linalg import solve_banded

描述BSM方程结构的类:BSMModel

class BSMModel:

def __init__(self, s0, r, sigma):

self.s0 = s0

self.x0 = math.log(s0)

self.r = r

self.sigma = sigma

def log_expectation(self, T):

return self.x0 + (self.r - 0.5 * self.sigma * self.sigma) * T

def expectation(self, T):

return math.exp(self.log_expectation(T))

def x_max(self, T):

return self.log_expectation(T) + 4.0 * self.sigma * math.sqrt(T)

def x_min(self, T):

return self.log_expectation(T) - 4.0 * self.sigma * math.sqrt(T)

描述我们这里设计到的产品的类:CallOption

class CallOption:

def __init__(self, strike):

self.k = strike

def ic(self, spot):

return max(spot - self.k, 0.0)

def bcl(self, spot, tau, model):

return 0.0

def bcr(self, spot, tau, model):

return spot - math.exp(-model.r*tau) * self.k

完整的隐式格式:BSMScheme

class BSMScheme:

def __init__(self, model, payoff, T, M, N):

self.model = model

self.T = T

self.M = M

self.N = N

self.dt = self.T / self.M

self.payoff = payoff

self.x_min = model.x_min(self.T)

self.x_max = model.x_max(self.T)

self.dx = (self.x_max - self.x_min) / self.N

self.C = np.zeros((self.N+1, self.M+1)) # 全部网格

self.xArray = np.linspace(self.x_min, self.x_max, self.N+1)

self.C[:,0] = map(self.payoff.ic, np.exp(self.xArray))

sigma_square = self.model.sigma*self.model.sigma

r = self.model.r

self.l_j = -(0.5*sigma_square*self.dt/self.dx/self.dx - 0.5 * (r - 0.5 * sigma_square)*self.dt/self.dx)

self.c_j = 1.0 + sigma_square*self.dt/self.dx/self.dx + r*self.dt

self.u_j = -(0.5*sigma_square*self.dt/self.dx/self.dx + 0.5 * (r - 0.5 * sigma_square)*self.dt/self.dx)

def roll_back(self):

for k in range(0, self.M):

udiag = np.ones(self.N-1) * self.u_j

ldiag = np.ones(self.N-1) * self.l_j

cdiag = np.ones(self.N-1) * self.c_j

mat = np.zeros((3,self.N-1))

mat[0,:] = udiag

mat[1,:] = cdiag

mat[2,:] = ldiag

rhs = np.copy(self.C[1:self.N,k])

# 应用左端边值条件

v1 = self.payoff.bcl(math.exp(self.x_min), (k+1)*self.dt, self.model)

rhs[0] -= self.l_j * v1

# 应用右端边值条件

v2 = self.payoff.bcr(math.exp(self.x_max), (k+1)*self.dt, self.model)

rhs[-1] -= self.u_j * v2

x = solve_banded((1,1), mat, rhs)

self.C[1:self.N, k+1] = x

self.C[0][k+1] = v1

self.C[self.N][k+1] = v2

def mesh_grids(self):

tArray = np.linspace(0, self.T, self.M+1)

tGrids, xGrids = np.meshgrid(tArray, self.xArray)

return tGrids, xGrids

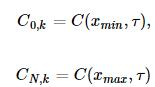

应用在一起:

model = BSMModel(100.0, 0.05, 0.2)

payoff = CallOption(105.0)

scheme = BSMScheme(model, payoff, 5.0, 100, 300)

scheme.roll_back()

from matplotlib import pylab

pylab.figure(figsize=(12,8))

pylab.plot(np.exp(scheme.xArray)[50:170], scheme.C[50:170,-1])

pylab.xlabel('$S$')

pylab.ylabel('$C$')

<matplotlib.text.Text at 0x76ea7d0>

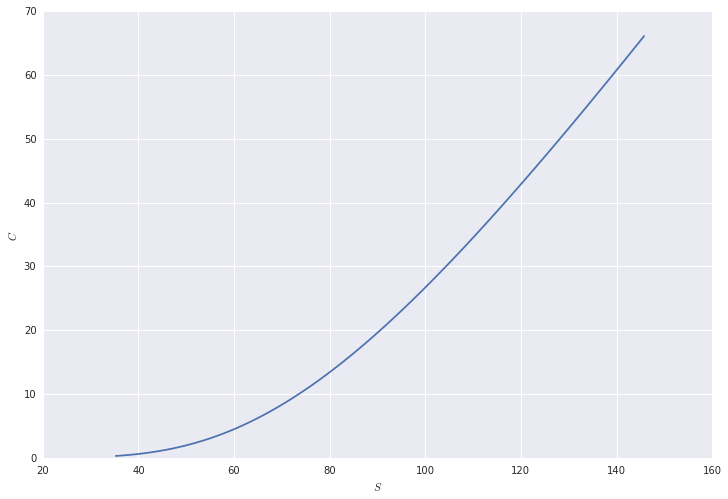

4. 收敛性测试

首先使用BSM模型的解析解获得精确解:

analyticPrice = BSMPrice(1, 105., 100., 0.05, 0.0, 0.2, 5.)

analyticPrice

| price | delta | gamma | vega | rho | theta | |

|---|---|---|---|---|---|---|

| 1 | 26.761844 | 0.749694 | 0.00711 | 71.10319 | 241.037549 | -3.832439 |

我们固定时间方向网格数为3000,分别计算不同S网格数情形下的结果:

xSteps = range(50,300,10)

finiteResult = []

for xStep in xSteps:

model = BSMModel(100.0, 0.05, 0.2)

payoff = CallOption(105.0)

scheme = BSMScheme(model, payoff, 5.0, 3000, xStep)

scheme.roll_back()

interp = CubicNaturalSpline(np.exp(scheme.xArray), scheme.C[:,-1])

price = interp(100.0)

finiteResult.append(price)

我们可以画下收敛图:

anyRes = [analyticPrice['price'][1]] * len(xSteps)

pylab.figure(figsize = (16,8))

pylab.plot(xSteps, finiteResult, '-.', marker = 'o', markersize = 10)

pylab.plot(xSteps, anyRes, '--')

pylab.legend([u'隐式差分格式', u'解析解(欧式)'], prop = font)

pylab.xlabel(u'价格方向网格步数', fontproperties = font)

pylab.title(u'Black - Scholes - Merton 有限差分法', fontproperties = font, fontsize = 20)

<matplotlib.text.Text at 0x7857bd0>